Top Glove Corporation Bhd

(Company No. 199801018294 [474423-X])

Top Glove Media Contact:

Michelle Voon

[email protected]

+603-3362 3098 Ext 2228

+6016 668 8336

Investor Contact:

Qiuvy Chong

[email protected]

+603-3362 3098 Ext 2234

+6012 265 8973

PRESS RELEASE

For Immediate ReleaseREVENUE AND VOLUME GROWTH AMIDST CHALLENGING ENVIRONMENT

Financial results for the fourth quarter and full year ended 31 August 2014

Klang, Tuesday, 14 October 2014 – Top Glove Corporation Bhd (“Top Glove” or “The Group”) today

announced its results for the financial year ended 31 August 2014 (“FY2014”).

The Group achieved revenue of RM580.2 million in the fourth quarter ended 31 August 2014

(“4QFY2014”), an increase of 5.8% against 4QFY2013. This was driven by a steady rise in demand for

rubber gloves, also reflected in sales volume which recorded growth year-on-year, albeit at a more

modest 3%.

Compared with FY2013, volume also rose by 3%. Nitrile gloves contributed significantly to this with a

substantial volume growth of 23.7% from the last year, and now account for 24% of total Group sales

volume, up from 20% in the previous year. Meanwhile, demand for natural rubber gloves remained

fairly consistent.

However, full year revenue for The Group came in at RM2.276 billion in FY2014, 1.6% lower

compared with FY2013.

Profit before tax also eased by 28.9% to RM47.7 million in 4QFY2014 and 11.4% to RM214.7 million

in FY2014, versus the corresponding periods in the preceding financial year.

The Group’s bottomline was affected by the 19% increase in natural gas prices which took place in

May, with the full impact being felt in the recent quarter. Further aggravating the situation were the

knock-on inflationary effects which followed increases in utility costs for electricity at 16%, in addition

to natural gas. Moreover, intensification of competition in the nitrile segment resulted in compressed

margins.

Meanwhile, raw material prices continued to trend down compared with FY2013, as natural latex fell

by 17.3% to an average of RM4.77/kg and nitrile latex price contracted by 8.3% to an average of

RM3.51/kg in FY2014. However, the positive impact/benefit from this was minimal in light of the

competitive environment which compelled any cost savings gained to be passed on to the customers.

Commenting on the Group’s performance, Chairman Tan Sri Lim Wee Chai said, “It has been a tough

year for us. The business environment has been challenging and we also recognise there are further

improvements that can be made operationally. We are determined to further step up our efforts in

quality enhancement and cost saving to deliver a better performance”.

Accordingly, the Group’s focus is steadfast on quality expansion. It recently saw to completion the

second phase expansion of Factory 27 in Lukut, Port Dickson with the addition of 6 higher- performing

production lines, while Factory 29 in Klang will be operational by January 2015 and will be fitted with

faster, more efficient, better quality and technologically advanced production lines.

Given the present business climate, increased M&A opportunities are also likely to present themselves,

thus enabling the Group to expand faster via the inorganic route, in addition to the organic expansion

being pursued.

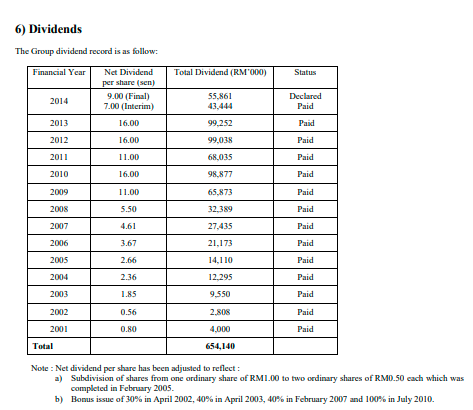

The Board of Directors of Top Glove has also proposed a final single tier dividend of 9 sen per share,

subject to shareholders’ approval at the forthcoming Annual General Meeting, which would bring the

total payout for the year to 16 sen per share, consistent with the previous year. In line with its

commitment to increasing shareholder value, the Group has also adopted a Dividend Policy to declare

and pay annual dividends of not less than 50% of its profit after tax and minority interest in respect of

future financial years.

As at 31 August 2014, the Group’s net cash remains positive at RM157.6 million, after factoring in

acquisitions and capital expenditure of RM226.5 million and interim dividend payment. It also

maintains a healthy balance sheet. Additionally, the Group also benefited from a lowered effective tax

rate.

In response to an urgent call to stem the spread of ebola in West Africa, Top Glove supported a recent

Government initiative that collected a donation of some 20.9 million gloves from Malaysian glove

manufacturers and private companies, to be shipped to nations stricken by the virus. In addition to

contributing gloves, the Group also project-managed the shipping of the said rubber gloves, to the

affected countries of Liberia, Sierra Leone, Guinea, Nigeria and The Democratic Republic of Congo.

Notwithstanding the softer performance, Tan Sri Lim remained upbeat about the company’s as well as

the industry’s prospects, observing, “The demand for rubber gloves is still strong as evidenced by the

sales volume we are seeing. There may be a temporary slowdown, but there is still overall growth.

With our on-going quality and automation improvement initiatives across our operations, we are

optimistic of a better showing in the quarters ahead

About Top Glove Corporation Berhad

Top Glove Corporation Berhad is listed on the Bursa Malaysia Stock Exchange Main Board and is one

of the component stocks of the FTSE Bursa Malaysia (“FBM”) Mid 70 Index, FBM Top 100 Index and

FBM Emas Index. Top Glove is currently the world’s largest rubber glove manufacturer with an

established corporate culture and good business direction of producing consistently high quality, cost

efficient gloves. Top Glove has over 2,000 customers worldwide and exports to more than 195

countries.

.jpg)

.png)

.png)

.png)

.png)

.png)