MARC AFFIRMS TOP GLOVE’S CORPORATE CREDIT RATING AT AA+, SEES IT VULNERABLE TO ACTIONS ON PERCEIVED VIOLATIONS OF LABOUR-RELATED ISSUES

11 April 2022 / 12:04

KUALA LUMPUR (April 11): MARC Ratings has affirmed Top Glove Corp Bhd’s corporate credit rating at AA+ and concurrently affirmed its wholly-owned TG Excellence Bhd’s RM3 billion Perpetual Sukuk Wakalah Programme rating at AA-IS(CG).

In a statement on Monday (April 11), MARC said the rating outlook is stable.

It said the rating of the perpetual sukuk reflects its subordination to the Top Glove group's senior unsecured obligations.

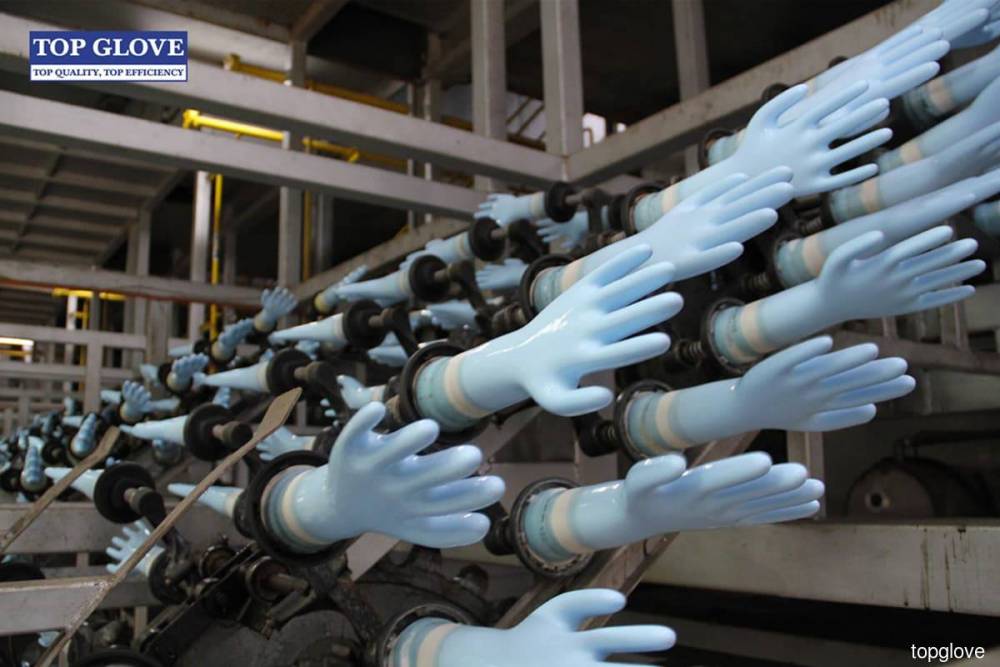

The rating agency said Top Glove’s leading global market position in glove manufacturing and very strong cash flow generation remain key rating drivers.

It said the rating considers the group’s ample liquidity position relative to its financial obligations.

“Moderating factors are rising global competition in the industry that may crimp margins, and the challenges associated with labour-related issues.

“We note that Top Glove has resolved its recent labour issues highlighted by the US government through remediation payments to workers and improving living conditions at its facilities.

“However, it remains vulnerable to actions on perceived violations of labour-related issues,” it said.

MARC said for the first half of the financial year ended Feb 28, 2022 (1HFY22), Top Glove recorded lower revenue and pre-tax profit of RM3 billion and RM371.1 million respectively as compared to RM10.1 billion and RM6.8 billion for the corresponding period last year.

It said the decline largely reflected easing concerns over the Covid-19 pandemic globally, contributing to sharply reduced selling prices to a more normalised level amid lower restocking activities.

“Sales volume was also partly affected by the import ban order imposed by the US government, which has since been rescinded.

“Nonetheless, increased awareness of hygiene issues as well as an expected recovery in sales to the US would remain supportive of sales demand.

“The operating profit margin remained healthy at 12.3% during 1HFY22,” it said.

MARC said Top Glove’s balance sheet had been further strengthened with a sharp increase in the equity base to RM6.9 billion as at end-1HFY22 (end-FY19: RM2.6 billion), providing strong adjusted debt-to-equity at 0.2 times.

“With cash balance of RM1.3 billion, the group is in a net cash position.

“Its capital structure is very likely to remain strong in the near term as its expansion to increase annual production capacity to 131 billion pieces by end-2023 from the current 100 billion pieces is expected to be funded internally.

“For now, the group has deferred its listing in Hong Kong, which was expected to generate proceeds of about RM1.5 billion,” it said.

At 10.05am on Monday, Top Glove was seven sen lower at RM1.90, valuing it at RM15.59 billion.

KLSE SCREENER

-cropped.jpg)

.jpg)

(1).jpg)

.png)

.png)

.png)

.png)

.png)

.png)