THIS MALAYSIAN GLOVE MAKER IS NOW AMONG THE TOP 15 BIGGEST CAP STOCKS ON SGX

27 May 2020 / 12:05

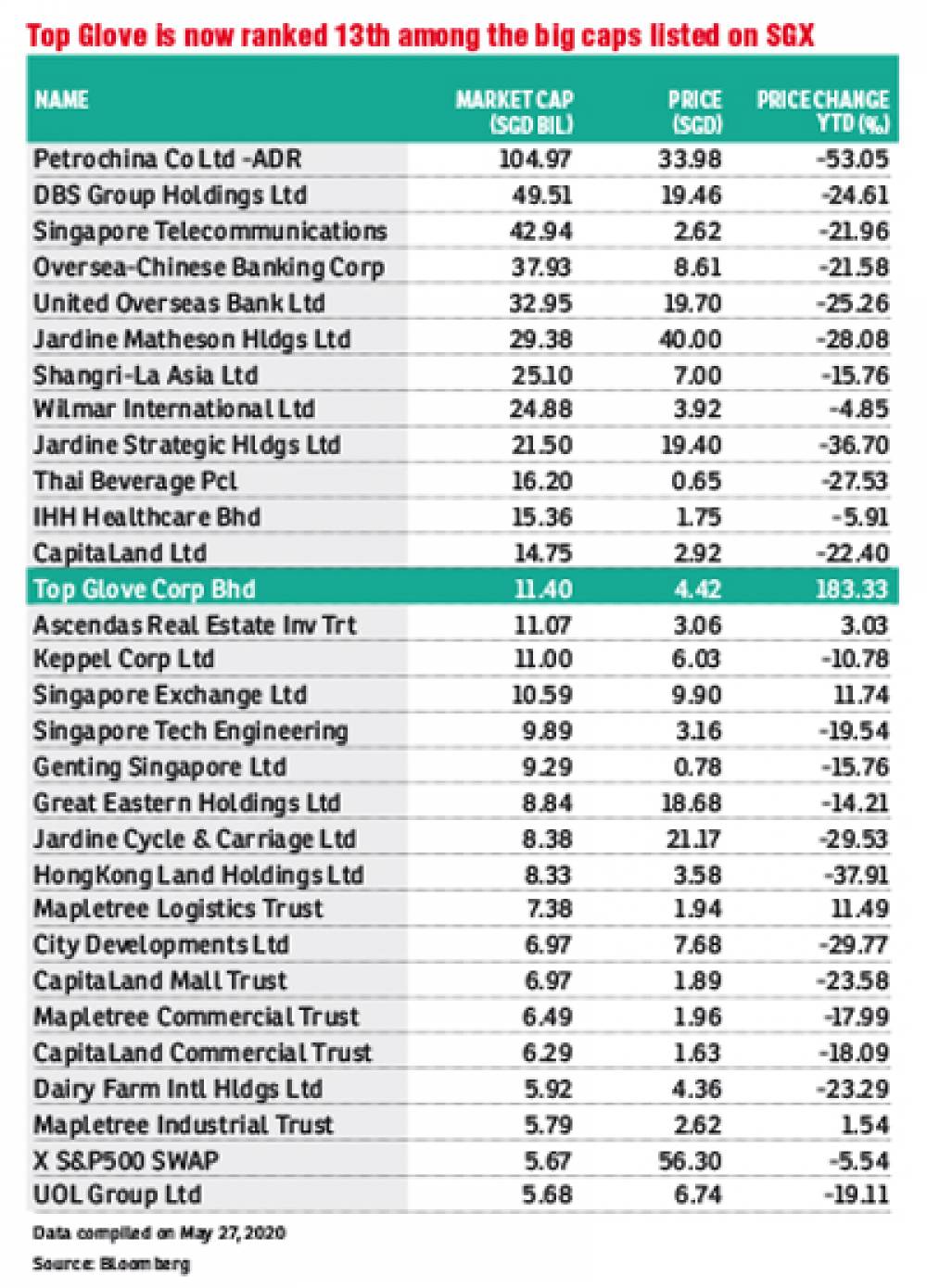

KUALA LUMPUR (May 27): Top Glove Corp Bhd, the world's largest rubber glove maker, is now the 13th biggest market cap stock on the Singapore Stock Exchange, with a market capitalisation of S$11.40 billion.

That is larger than conglomerates like Keppel Corp Ltd, Jardine Cycle & Carriage Ltd and even insurance giant Great Eastern Holdings Ltd.

According to Bloomberg, Keppel has a market capitalisation of S$11 billion, based on its last traded share price of S$6.03, making it the 15th biggest market cap company on SGX. Great Eastern has a market capitalisation of S$8.84 billion (share price:S$18.68), while Jardine Cycle & Carriage (share price: S$21.17) is valued at S$8.38 billion. These ranked them as the 19th and 20th largest market cap stocks, respectively, on the SGX.

Keppel is a conglomerate whose businesses are in offshore and marine, infrastructure, property investment and development, telecommunications and transportation, energy, and engineering. The group reported an annual net profit of S$761.14 million for the financial year ended Dec 31, 2019 (FY19), with a turnover of S$7.6 billion.

Great Eastern, which is majority-owned by Oversea-Chinese Banking Corp, earned a net profit of S$1 billion in FY19, with an annual turnover of S$1.26 billion.

Jardine Cycle & Carriage, the investment holding company of the Jardine Matheson Group in Southeast Asia, is involved in automotive, consumer finance, utilities and infrastructure, heavy equipment and mining, property, agribusiness, cement, and consumer products businesses. Its net earnings came in at US$881 million in FY19, on a revenue of US$18.59 billion.

Top Glove, on the other hand, made a net profit of RM227.11 million in the first six months of its FY20 ended Feb 29, with a revenue of RM2.44 billion. Earnings per share (EPS) for the cumulative period was at 8.87 sen.

Since Dec 31, 2019, a bull run among glove makers on the SGX has sent Top Glove's stock price soaring some 182% from S$1.56. At noon break today, the stock was trading at S$4.40 on the SGX, down 2 sen or 0.45% from the previous close.

Similarly, Riverstone Holdings Ltd's share price has jumped 137% year-to-date from 93 cents, while UG Healthcare Corp Ltd is up 221% from 14 cents. Riverstone, with an annual production capacity of about 9 billion gloves, makes premium nitrile gloves for the healthcare industry, as well as nitrile and natural rubber clean room gloves. UG Healthcare makes disposable gloves under its own 'Unigloves' brand.

Today, Riverstone's share price climbed 3.29% or seven cents to S$2.20, giving it a market capitalisation of S$1.63 billion. For UG Healthcare, the stock jumped 21.62% or eight cents to 45 cents, bringing a market capitalisation of S$72.55 million.

This trio of rubber glove companies on the SGX now have a combined market capitalisation of over S$13 billion. For contrast, their combined market cap was just over $S5 billion at the start of March.

In Malaysia, the dual-listed Top Glove is the 15th largest market cap stock among the 30 component stocks on the benchmark FBM KLCI. As at 12.30pm today, its market capitalisation stood at RM30.48 billion.

The counter continued to be among the top gainers on Bursa Malaysia this morning, climbing 8.29% or 98 sen to RM12.80, after some 17.22 million shares were traded at noon break.

Of the 22 research houses covering Top Glove, it has 16 “buy” calls, four “hold”, and two “sell”.

CGS-CIMB Research, which has maintained its ‘add’ call on Top Glove, said it has turned more positive on Top Glove’s earnings prospects, as it expects Top Glove to be able to raise its average selling prices (ASPs) aggressively, as much as 10% per month from June to Dec this year, due to the strong global glove demand and longer order book visibility.

“We raise our FY20-22F EPS by 7.8%-44.9% due to higher ASP increases and better profit margins from higher economies of scale and lower raw material prices (nitrile butadiene and natural latex prices have declined 14% and 7% YTD, respectively),” the research house said in a note distributed today.

According to CGS-CIMB Research, Top Glove's current order lead time has further extended to 11 to 12 months, compared to the research house’ assumption of eight months previously, which gives Top Glove a longer order book visibility of up to May/June, 2021.

CGS-CIMB Research, which has also raised its target price for Top Glove to RM16.50 from RM10.40 previously, expects Top Glove to generate an annual profit of RM864 million for the financial year ending Aug 31, 2020 (FY20), and to grow its earnings further to RM1.22 billion for FY21 and RM1 billion for FY22. This translates into EPS forecasts of 34 sen for FY20, 47 sen for FY21 and 39 sen for FY22.

One of the key beneficiaries of the Covid-19 outbreak, Top Glove has been enjoying stronger demand from existing customers, as well as the coming on board of new customers such as non-government and government organisations with ad-hoc orders.

“In our view, Top Glove is able to cater to these ad-hoc orders, as it has excess capacity, especially in the latex segment (running at ~80% utilisation rate as at Feb 20 pre-Covid-19). Also, Top Glove will be able to leverage on new glove capacity, as its total production capacity will rise by 8% (+5.9 billion pieces per annum) to 79.7 billion pieces per annum by end-2020F,” it added.

-cropped.jpg)

.jpg)

(1).jpg)

.png)

.png)

.png)

.png)

.png)

.png)