EYEING ACQUISITION IN INDONESIA, THAILAND ON BACK OF WEAK RINGGIT

01 October 2015 / 12:10

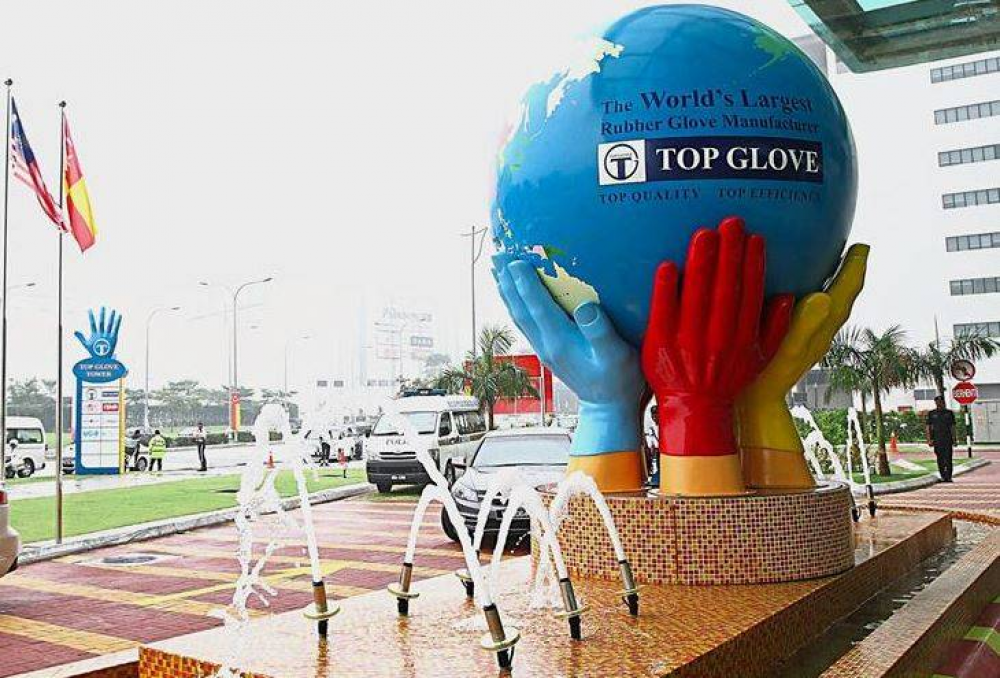

KUALA LUMPUR: Malaysia's Top Glove Corp. is scanning targets locally as well as in Indonesia and in Thailand for potential acquisition, as a weak ringgit and soft commodity prices boost earnings of the world's largest glove producer by volume.

The company is aiming to acquire within one year at least one of the "three or four parties" that it is currently in talks with, its chairman Lim Wee Chai told reporters on the side lines of a corporate event Thursday. He didn't identify the targets.

"This year, we will be more aggressive because we have strong financial strength, healthy balance sheet and net cash," Lim said. "Hopefully within a year, we (will) have some good news to share.

A slump in the Malaysian ringgit has boosted sales of exporters like Top Glove that price most of their goods in the U.S. dollar. Most commodity prices including that of latex, which typically account for half of rubber glove production cost, have declined. This has shrunk input costs for glove manufacturers and are helping boost profits, drawing cheers from investors.

Shares of Top Glove have surged more than 75% so far this year. That compares to the country's benchmark FTSE Bursa Malaysia KLCI which has shed 7.2% year to-date.

The company's fiscal third quarter net profit jumped 70% on-year, while quarterly revenue climbed 13% to 661.2 million ringgit, the company's highest since its 2001 listing.

The ringgit, Asia's worst-performing currency, has been plumbing new 17-year lows after losing more than 20% of its value against the U.S. dollar so far this year as decline in crude oil prices and an ongoing political scandal involving a state investment fund have battered investor's interest in Southeast Asia's third largest economy.

For every 1.0%increase in the U.S. dollar against Malaysia's ringgit the glove industry's earnings could rise by up to 7%, estimates MIDF Amanah Investment Bank analyst Lester Chin.

Signs of economic weakness in China, the world's biggest importer of rubber, have helped to keep a lid on the prices of the commodity as supply outstrips demand. The glut remains despite efforts by Malaysia, Indonesia, and Thailand to cut output of the material used in manufacturing of products ranging from gloves to car tires. The three countries collectively control more than two-thirds of the world's total rubber output.

Prices of latex concentrate, bought mostly in local currency, are currently trading at a "reasonable" price of between 4 ringgit and 5 ringgit a kilogram, a price band that could be sustained for another year, Lim said.

Top Glove produces up to 44.6 billion pieces of gloves a year at its 27 factories in Malaysia, Thailand and China. The company has budgeted 3 billion ringgit (about $680 million) over the next 15 years to fund technology upgrades and add 4 billion pieces in annual capacity.

Malaysian glove makers, including Top Glove's rival Hartalega Holdings, collectively export over 100 billion pieces of gloves a year, accounting for more than 60% of the world supply.

Nikkei Asia

-cropped.jpg)

.jpg)

(1).jpg)

.png)

.png)

.png)

.png)

.png)

.png)