CAUTIOUS RESPONSE TO TOP GLOVE BUY

02 December 2017 / 12:12

Analysts say company needs to be wary of debt risks in move to buy Aspion

THE billion ringgit question has been answered.

Top Glove Corp Bhd image: https://cdn.thestar.com.my/Themes/img/chart.png

has finally announced that the Malaysian glove company that it has been courting in the last two months or so is none other than surgical glove specialist Aspion Sdn Bhd.

The proposed move to acquire Aspion, worth at least RM1.3bil, is said to be one of the biggest investments it has made since its initial public offering 17 years ago.

As its head honcho Tan Sri Dr Lim Wee Chai aptly put in all his financial results briefings – “Any time can be the right timing for an M&A, as long as the company is suitable and we have the resources.”

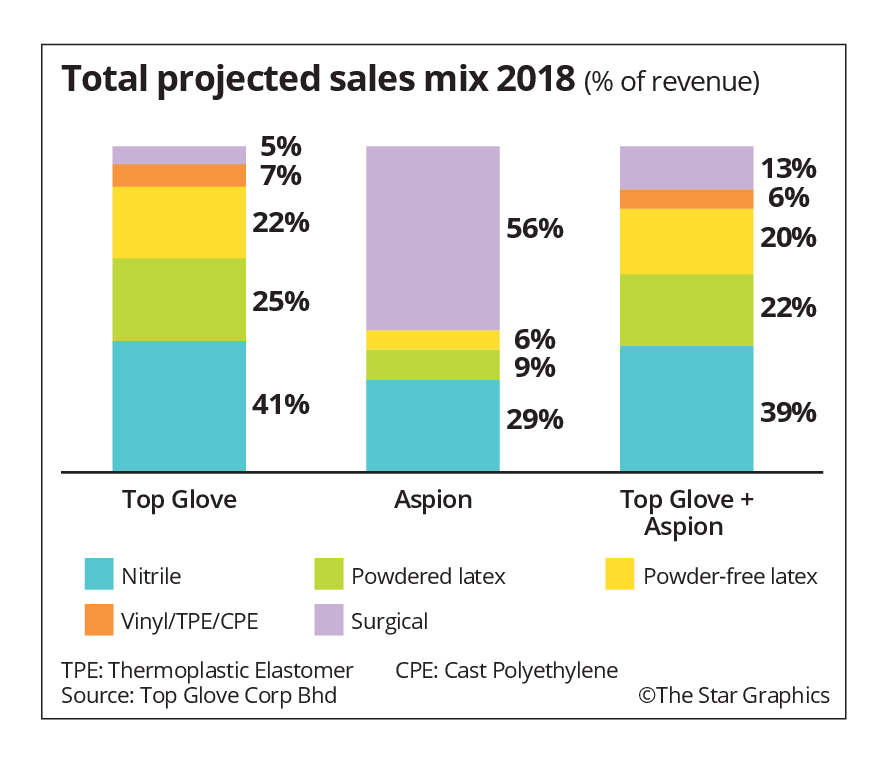

There is so much upside to the new deal in the making, considering the surgical gloves business offers higher margins due to its product quality, technology and the research and development involved in its production.

It is also a market that has high barriers to entry that confront many glove players in a rapidly growing global healthcare industry.

So, while this is a premium investment that would inevitably see Top Glove move up the value chain to gain a global market leader’s position in the surgical gloves business, the proposed deal somehow did not overwhelm the market entirely.

Firstly, the market was not surprised since Lim had tipped off the media and analysts about his RM1bil potential target last month.

Top Glove entered into a deal last week to buy Aspion from

Adventa image: https://cdn.thestar.com.my/Themes/img/chart.png

Capital Pte Ltd via a combination of borrowings and new shares.

The proposed deal also comes with Adventa providing a profit after tax (PAT) guarantee of RM80mil for the financial year ending Oct 31, 2018 (FY18), translating into a price-to-earnings multiple of 16 to 18 times.

Also, Adventa is required to reimburse Top Glove should it fail to meet the PAT target.

Secondly, while the proposed deal is seen to be value accretive to Top Glove, several research houses have indicated certain areas that Top Glove need to be wary of.

UOB Kay Hian Research analyst Chan Jit Hoong believes Top Glove will see a jump in net gearing to 0.6 times, from net cash position previously.

According to Chan, this is due to Aspion’s high borrowings and Top Glove taking on a 90% US dollar (USD) denominated debt, to fund the proposed acquisition.

“Hence, we predict competing need for operating cash flow (OCF).

“On a standalone basis, OCF is already fully taken up by capital expenditure (capex) and dividend requirements.

“Consequently, we think it is difficult to keep the same capex level of 5%-10% of sales,” UOB Kay Hian notes, adding that this could affect Top Glove’s ability to chalk a historical five-year compounded annual growth rate (CAGR) of 10%.

He also thinks that should the Fed raise interest rates, then the risk of a higher cost of borrowings could surface.

The house kept a “hold” call with a higher target price of RM6.38, from RM5.65 previously, as it rolled valuation to 2019 and based on an unchanged 18 times to 2019 forecast earnings per share (EPS).

On a positive note, Chan says it is going to be value accretive, in view that Top Glove’s current forward price-to-earning (PE) of 23 times is higher than Aspion’s 16 to 18 times.

Top Glove’s FY18 EPS could rise by 10%, assuming a full-year contribution from Aspion.

That said, Chan thinks a premium valuation is needed for a takeover to materialise and thus, opportunity like this does not come by often.

Another analyst also concurred with UOB Kay Hian’s views, adding that Top Glove could turn to net debt of RM1.52bil to RM1.68bil, from proforma net cash of RM71mil as at end of August, 2017.

This is after including the 90% debt to finance Aspion, Top Glove’s recent acquisition of Eastern Press Sdn Bhd for MR47mil, Aspion’s existing net debt of RM264mil and the enlarged share base for Top Glove to fund the balance 10% of the acquisition value.

The analyst notes that Top Glove’s existing shareholder’s stake in the group will dilute with Aspion’s managing director Low Chin Guan holding a stake in Top Glove.

Lim addresses concerns

To put things in perspective, Lim, who is Top Glove’s executive chairman, explains that the US dollar borrowings are still cheaper than having debt in ringgit.

“Our indicative US dollar cost of funding range from 2.5% to 3%, whereas ringgit borrowings cost is at 4.5% to 4.8%, a difference of around 1.5% – which translates to around RM19mil savings per annum,” he says.

While Top Glove is aware of the Fed likely to raise interest rates, Lim says with Bank Negara indicating higher ringgit borrowing costs, this could fall in the same quantum.

Almost 97% of Top Gloves sales proceeds are dollar-denominated.

Lim: A dollar loan will give us a perfect natural hedge in the event of currency fluctuations.

“Therefore, a dollar loan will give us a perfect natural hedge, in the event of currency fluctuations. “

Ringgit borrowings, may result in mismatch due to the inflow of sales proceeds in dollars,” he elaborates.

Additionally, Top Glove will also take up a portion of the dollar loan with Islamic loan feature to adhere to the syariah index requirement since it is a syariah compliant stock, Lim notes.

The glove tycoon perceives the 0.6 times net gearing level an acceptable range for a growth company that is in a rapidly evolving healthcare sector, which is recession proof.

Having said that, he feels that doing business with net cash position does not mean it’s good, as it could indicate that it was too comfortable to take risks.

Once the acquisition is completed in February 2018, Top Glove will see a 20% immediate growth in revenue and profit – surpassing the five-year CAGR of 10% growth.

In terms of cash flow, Lim notes that Top Glove has sufficient internal cash flow to fund its organic expansion (excluding acquisition).

For FY17, the company’s cash flow from operating activities stood at RM381mil.

“New expansions that has kicked off in the last few years will start generating cash and this will improve our cash flow in FY18.

“This will be more than sufficient to meet our organic expansion capex of around RM200mil to RM250mil,” Lim affirms.

The Star

-cropped.jpg)

.jpg)

(1).jpg)

.png)

.png)

.png)

.png)

.png)

.png)